RTA-Data

Mario Larch's Regional Trade Agreements Database

This database includes all multilateral and bilateral regional trade agreements as notified to the World Trade Organization for the last 74 years from 1950 to 2023. There is a total of 592 agreements in the dataset that are differentiated along seven different categories. Additionally there are variables indicating whether countries were founding members or joined later.

There are two versions in two file formats available:

- rta_20241028.dta or rta_20241028.csv: This file includes dummies for “rta”, “cu”, “fta”, “psa”, “eia”, “cueia”, “ftaeia”, and “psaeia”.

- rta_individual_agreements_20241028 DTA or CSV is identical to rta_20241028 but includes three dummies for each of the 592 individual agreements that allow to distinguish the agreements and to distinguish between entry into force of agreements and enlargements.

See readme_RTA.pdf for a detailed description of the data, the countries and time period covered.

The underlying do-files have passed several rounds of debugging. If you still find factual errors or typos in our code, we would be very grateful if you let us know.

In case you use our data, we would kindly like to ask you to refer to the data as:

“Mario Larch’s Regional Trade Agreements Database from Egger and Larch (2008)” where Egger and Larch (2008) refers to the following paper:

Egger, Peter H. and Mario Larch (2008), Interdependent Preferential Trade Agreement Memberships: An Empirical Analysis, Journal of International Economics 76(2), pp. 384-399.

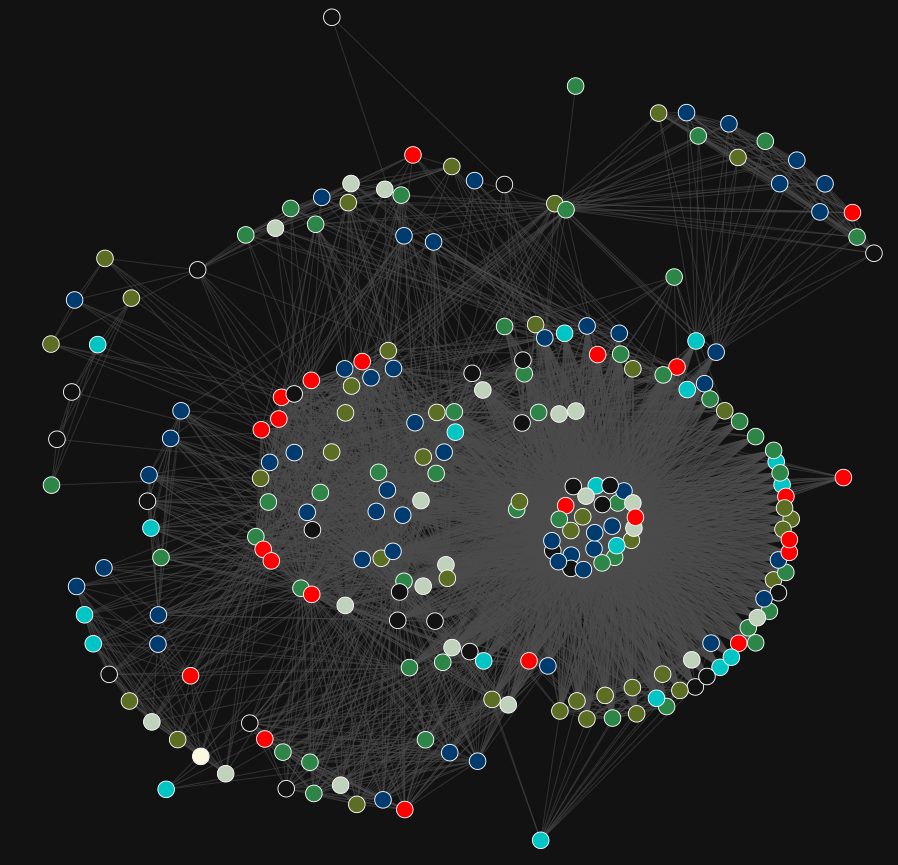

RTA-Total-Network-Dynamic (By clicking the link you see a dynamic version of the graph.)

This graph visualizes the deepening of the RTA network from 1950 to 2019. Each dot represents a country. The colors of the dots show to which continent the country belongs:

- mid-dark green for Africa (HEX code "#339151")

- mid-dark yellow-green for Asia (HEX code “#677828”)

- dark cyan-blue for Europe (HEX code "#00437a")

- red for North America (HEX code "#ff0000")

- mid-dark cyan for Oceania (HEX code “#00cccc”)

- light green for South America (HEX code "#C7D7C4")

The color names are obtained from https://encycolorpedia.de. When countries are no longer in existence, the dot is showing “NA”. The edges connect the dots as soon as an RTA between the countries comes into existence. Please use this graph interactively. You can stop at any time and select the dots by clicking on them to see the country names. Double-clicking on a dot will highlight it and all the dots connected to it even while the animation is running. By zooming in and out, you get a different perspective on the RTA network. By clicking and dragging the cursor you can move the network around.

For an analysis of the data using traditional estimation and modern machine learning techniques please refer to Blöthner and Larch (2022),“Economic Determinants of Regional Trade Agreements Revisited Using Machine Learning”, Empirical Economics 63, pp. 1771-1807.

Selected papers using this database:

- 1. Egger, Peter H. and Mario Larch (2011), An Assessment of the Europe Agreements’ Effects on Bilateral Trade, GDP, and Welfare, European Economic Review 55(2), pp. 263–279.

- 2. Egger, Peter H., Mario Larch, Kevin Staub, and Rainer Winkelmann (2011), The Trade Effects of Endogenous Preferential Trade Agreements, American Economic Journal: Economic Policy 3(3), pp. 113–143.

- 3. Felbermayr, Gabriel, Benedikt Heid, Mario Larch, and Erdal Yalcin (2015), Macroeconomic Potentials of Transatlantic Free Trade: A High Resolution Perspective for Europe and the World, Economic Policy 83(3), pp. 491–537.

- 4. Bergstrand, Jeffrey H., Peter H. Egger, and Mario Larch (2016), Economic Determinants of the Timing of Preferential Trade Agreement Formations and Enlargements, Economic Inquiry 54(1), pp. 315–341.

- 5. Heid, Benedikt and Mario Larch (2016), International Trade and Unemployment: A Quantitative Framework, Journal of International Economics 101, pp. 70–85.

- 6. Yotov, Yoto V., Roberta Piermartini, José-Antonio Monteiro, and Mario Larch (2016), An Advanced Guide to Trade Policy Analysis: The Structural Gravity Model, World Trade Organization Geneva.

- 7. Jackson, Karen and Oleksandr Shepotylo (2018), Post-Brexit Trade Survival: Looking Beyond the European Union, Economic Modelling 73, pp. 317–328.

- 8. Larch, Mario, Joschka Wanner, and Yoto V. Yotov (2018), Bi- and Unilateral Trade Effects of Joining the Euro, Economics Letters 171, pp. 230–234.

- 9. Sellner, Richard (2019), Non-discriminatory Trade Policies in Panel Structural Gravity Models: Evidence from Monte Carlo Simulations, Review of International Economics 27(3), pp. 854–887.

- 10. Shepherd, Ben (2019), Mega-regional Trade Agreements and Asia: An Application of Structural Gravity to Goods, Services, and Value Chains, Journal of the Japanese and International Economies 51, pp. 32-42.

- 11. Anderson, James E., Mario Larch and Yoto V. Yotov (2020), Transitional Growth and Trade with Frictions: A Structural Estimation Framework, The Economic Journal 130(630), pp. 1583-1607.

- 12. Greaney, Theresa M. and Kozo Kiyota (2020), The Gravity Model and Trade in Intermediate Inputs, The World Economy 43(8), pp. 2034-2049.

- 13. Heid, Benedikt, Mario Larch, and Yoto V. Yotov (2020), Estimating the Effects of Nondiscriminatory Trade Policies within Structural Gravity Models, Canadian Journal of Economics 54(1), 376-409.

- 14. Heid, Benedikt and Isaac Vozzo (2020). The International Trade Effects of Bilateral Investment Treaties, Economics Letters 196, article 109569.

- 15. Kox, Henk L.M. and Hugo Rojas‐Romagosa (2020), How Trade and Investment Agreements Affect Bilateral Foreign Direct Investment: Results from a Structural Gravity Model, The World Economy 43(12), pp. 3203-3242.

- 16. Sharafeyeva, Alfinura and Ben Shepherd (2020), What Does “Doing Business” Really Measure? Evidence from Trade Times, Economics Letters 192, article 109215.

- 17. Cyrus, Teresa L. (2021), Why Do Countries Form Regional Trade Agreements? A Discrete-Time Survival Analysis, Open Economies Review 32(2), pp. 417-434.

- 18. El-Sahli, Zouheir (2021), The Partial and General Equilibrium Effects of the Greater Arab Free Trade Agreement, The International Trade Journal, pp. 1-15.

- 19. Larch, Mario, Aiko Schmeißer and Joshka Wanner (2021), A Tale of (almost) 1001 Coefficients: The Deep and Heterogeneous Effects of the EU‐Turkey Customs Union, Journal of Common Market Studies 59(2), pp. 242-260.

- 20. Oberhofer, Harald and Michael Pfaffermayr (2021), Estimating the Trade and Welfare Effects of Brexit: A Panel Data Structural Gravity Model, Canadian Journal of Economics 54(1), pp. 338-375.

- 21. Alaamshani, Imad Kareem, Hanny Zurina Hamzah, Shivee Ranjanee Kaliappan and Normaz Wana Ismail (2022), Effects of Trade Facilitation on Trade Costs in Developed and Developing Countries: PPML Analysis, Institutions and Economies, pp. 31-58.

- 22. Ando, Mitsuyo, Shujiro Urata and Kenta Yamanouchi (2022), Do Japan's Free Trade Agreements Increase Its International Trade?, Journal of Economic Integration 37(1), pp. 1-29.

- 23. Blöthner, Simon and Mario Larch (2022), Economic Determinants of Regional Trade Agreements Revisited Using Machine Learning, Empirical Economics 63, pp. 1771-1807.

- 24. Lee, Woori, Alen Mulabdic and Michele Ruta (2023), Third-Country Effects of Regional Trade Agreements: A Firm-Level Analysis, Journal of International Economics 140, 103688

- 25. Larch, Mario, and Joschka Wanner (2024), The Consequences of Non-participation in the Paris Agreement, European Economic Review 163, 104699.

- 26. Syropoulos, Constantinos, Gabriel Felbermayr, Aleksandra Kirilakha, Erdal Yalcin, and Yoto V. Yotov (2024), The Global Sanctions Data Base–Release 3: COVID‐19, Russia, and Multilateral Sanctions, Review of International Economics 32(1) pp. 12-48.